PropNex Picks

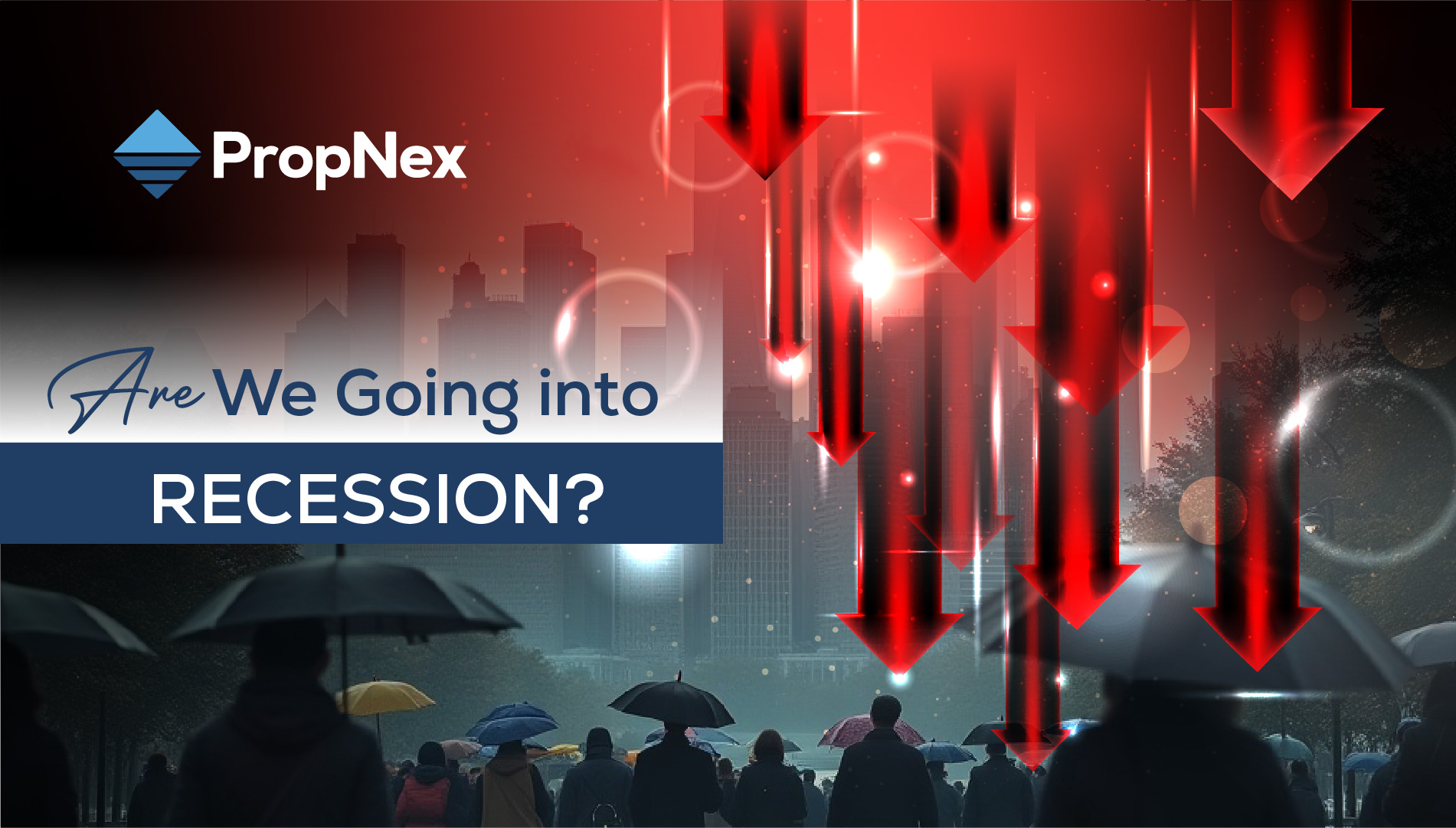

|June 27,2025Are We Going into Recession?

Share this article:

With the US slapping tariffs and global trade tensions escalating again, Singapore is on the brink of a technical recession. Permanent Secretary at the Ministry of Trade and Industry (MTI) Beh Swan Gin has issued a warning since it was confirmed that GDP growth was in the red in the last quarter.

And although this doesn't guarantee a full-blown recession, whenever the "R" word appears in headlines, we all ask the same question: What's going to happen to property prices if we do go into a recession? Well, let's break it down.

Let's start with the basics. A recession is basically a prolonged period of negative economic growth. It's one of the four recurring phases of the economic cycle: expansion, peak, recession, and trough (a.k.a. the bottom before recovery begins again).

It can be frustrating to see growth stall or reverse, but it's worth noting that historically, economies spend far more time expanding than they do contracting. Recessions are the dips, not the default.

Now to the golden question. What does a recession mean for the property market?

1. Slowing price growth or declines

Historically, recessions have led to slower growth or temporary dips in property prices. For example, private property prices dropped about 20% from their peak in 2008 to the first quarter of 2009. Fortunately, it didn't spiral out of control because the government took proactive measures to stabilise the market. As confidence returned, prices started to recover. From March 2009, prices continued going up, with a 104% increase by the end of 2012.

Source: PropNex Investment Suite

Then, during the COVID-19 pandemic, despite severe economic disruption and job uncertainty, property prices showed more resilience than expected. After some brief fluctuations between February and September 2020, prices slowly rebounded. This was partly due to easing interest rates and limited supply. Between 2020 and 2025, private property prices have risen by about 38%. This means that the market was much more controlled compared to previous recessions.

Source: PropNex Investment Suite

So yes, prices may dip during a recession. But history suggests that they usually bounce back stronger. And unlike the stock market that is much more volatile and unpredictable, Singapore's property market is held up by limited supply, government intervention, and consistent demand. So, downturns don't last very long. If anything, it can present a great opportunity to enter the market at lower prices. Just ask anyone who bought a unit during COVID, no regrets there.

2. Fewer transactions, fewer supply

When uncertainty like a recession creeps in, people tend to take the wait-and-see approach. Buyers get more cautious, sellers hold back, and developers may delay launches.

It's not just fear, it's also practicality. People delay big-ticket purchases in case job stability becomes an issue. Sellers, on the other hand, may not want to let go of their properties unless they absolutely have to, especially if prices aren't in their favour.

Furthermore, when demand slows down, it makes sense that supply does too. Developers may not be confident that they can sell out their units, and they don't want to risk paying an ABSD. So, they may hold off on new projects and avoid launching into a weak market, which means less supply.

All this leads to a visible drop in transaction volume. For example, in Q2 2020, developers sold just 1,713 private homes, down from 2,149 the previous quarter. No new executive condominiums (ECs) were launched, and EC sales fell drastically from 590 to 71. The resale market also took a hit, with transactions nearly halving from 2,080 to 933.

3. Weak rental market

Recessions also impact the rental segment, both commercial and residential.

On the commercial side, businesses affected by the slowing economy may scale down operations or shut down altogether, leading to more vacant units. And since new businesses are unlikely to open during uncertain times, many of these spaces remain unoccupied. So, landlords may feel pressured to offer discounts, shorter leases, or other incentives to secure or keep tenants.

Residential rental demand also takes a hit during recessions, largely due to rising unemployment and wage cuts. While locals are also affected, expats are often the first to be laid off for redundancy or have their wages cut. So they may downsize or even leave the country. Naturally, it can trigger a sharp drop in rental demand, especially in the central and city fringe. Much like commercial rent, landlords may have to lower rents or face longer vacancies.

4. Risk of mortgage default and foreclosure

Job losses and wage cuts can also make it harder for homeowners to keep up with their mortgage repayments, especially those who are highly leveraged or recently bought at peak prices. If they continue to miss the payments (this is what we call a mortgage default), after a certain amount of time, the lender may have no choice but to take back the property and sell it (also known as foreclosure).

While Singapore's lending framework is generally conservative (thanks to measures like the TDSR and MSR), that doesn't completely shield homeowners from mortgage defaults and foreclosure, especially in tough times.

5. Interest rates fall

One of the side effects of a recession (or the fear of one) is falling interest rates. The US Federal Reserve has already signalled that it may start cutting rates in late 2024 or early 2025, especially as inflation cools and growth moderates.

This could mean relief for homebuyers and those on floating rate packages. The 3M SORA rate, which most floating-rate home loans are pegged to, currently sits at around 2.9%. But analysts project it could fall to between 2.2% and 2.6% by the end of 2025. Some local banks have already begun lowering their fixed-rate packages in anticipation of this trend, which is an early sign that borrowing costs might start to ease.

Historically, mortgage rates follow a fairly consistent cycle: they climb for two years, stay high for another two, and then decline gradually over the next six years. This has played out across multiple crises:

During the 1998 asian financial crisis, rates spiked to 5% before plunging nearly 4.7% within 14 months.

In the 2008 global financial crisis, rates fell about 5% over 17 months.

In 2020, amid the COVID-19 pandemic, mortgage rates dropped to an all-time low of 1 - 2%.

During the inflation wave in 2022 - 2023, rates were pushed up to 3.0% - 3.5%.

If the cycle continues, and it often does in finance, we could expect rates to ease up, though it won't be as steep as it was in 2020. Still, a moderate decline could improve affordability for buyers and ease refinancing pressure for homeowners.

So, how do we know if a recession is on the horizon? Here are some of the telltale signs we should look out for:

1. Negative GDP growth

GDP figures are often the first flashing red lights when the economy hits turbulence. During the global financial crisis, Singapore slipped into recession in the third quarter of 2008 with a 2.1% contraction. By the fourth quarter, real GDP declined by 16.4%. Similarly, in 2020, the economy shrank by 2.2% in the first quarter and 13.2% in the next. And as I've mentioned, our GDP contracted just last quarter. So, that's the first warning sign that we may go into recession.

2. Rising unemployment

When economic activity slows down, naturally, there's higher unemployment as businesses reduce production and lay off workers. For example, in August 2020, the nation's overall unemployment rate rose to 3.4%, exceeding the high of 3.3% last recorded in September 2009 during the global financial crisis.

As for 2025, the Ministry of Manpower's (MOM) preliminary data indicates moderating labour demand. While the job market still expanded in Q1 2025, the growth was more subdued than in previous quarters. According to MOM, the resident unemployment rate rose from 2.8% in December 2024 to 2.9% in the first quarter of 2025. Meanwhile, the citizen unemployment rate remained at 3.1% in February and March, which is higher than the 2.9% recorded in December. Mind you, these figures still fall within the typical range for non-recessionary periods, but it's good to stay informed.

3. Dampened consumer spending

As I've mentioned, recession worries make people hold back on big-ticket items. Looking back, we saw this clearly during past recessions. 2008 and 2009 were rough years for the retail sector. Sales volume fell sharply, with a 9.3% drop in 2009 alone, similar to the decline seen during the SARS outbreak in 2003.

Source: Singapore Department of Statistics

Fast forward to the COVID-19 pandemic, and the numbers were even more severe since most stores were closed and dining in wasn't allowed. As a result, retail and F&B sales contracted YoY by up to 52%. Retail sales alone plunged 15.3%, breaking the record of the 11% drop in 1986.

And what about today? As of March 2025, the RSI rebounded 1.1% YoY after a 3.6% decline in February. But even with this slight recovery, sales dipped 2.8% on a seasonally adjusted MoM basis, which suggests that consumer sentiment is still pretty cautious.

That said, in the past, we've seen the government take proactive measures like issuing grants to help with local businesses. And, instead of just handing out cash (which people tend to keep), they gave out spending vouchers. These encouraged people to spend locally, which means more money circulates through the economy, businesses can stay afloat, and more people retain their jobs. So despite everything that was going on, we managed to stay resilient during the last crisis and bounce back relatively quickly.

Not necessarily. Warning of a technical recession sounds alarming. And with US tariffs, global tensions, and signs of a slowdown already showing up in our economy, the anxiety is understandable. But, it really doesn't seem like we're headed towards a prolonged downturn, at least not yet. Still, it's wise to stay cautious, informed, and prepared.

That said, even if we do enter a full-blown recession, rest assured that our property market has a good track record of resilience. After every major economic shock like the global financial crisis or the pandemic of COVID-19, property prices have bounced back and even surpassed previous highs. This is thanks to our limited land supply and proactive government policies that help stabilise the market during turbulent times.

What we're seeing today with the cautious mood, fewer launches, and slower sales are nothing new. In fact, it's the same pattern we've seen before each recovery. When fear takes over the market, people hold back on big purchases. But, those who understand the cycle will see this as a chance to enter the market at a good price point.

That's why having a long-term property plan is so important. And that's the core idea behind the Property Wealth System (PWS). This framework is designed to help you build a property portfolio that's resilient enough to withstand market cycles, not just ride the highs.

So if you've planned well, you don't have to panic. And if you haven't, this might be the best time to learn how. Watch this clip below for a quick breakdown on why fear in the market can actually be your window of opportunity.

So if you're a homeowner, don't panic-sell. And if you're a buyer, keep an eye out for the right project.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.