PropNex Picks

|June 06,2025Your Childhood Estate Called. It's Expensive Now.

Share this article:

Do you still feel nostalgic when you visit your parents at your childhood home? Maybe from the smell of your neighbour's cooking from the corridors, or the calming sound of wind chimes at your parents' front door. But that's about it, right? Everything else has changed.

The mama shop has turned into a 7-11, and your favourite kopitiam is now a minimalist brunch spot selling overpriced bread. Even the void deck feels off. It's quieter, cleaner, it's just different.

Places like Marine Parade, Punggol, Toa Payoh have all begun to change. Now there's an MRT station on every corner. And the old flats? Selling for over a million.

You used to complain about how boring your estate was. But now, you're thinking... Maybe got potential? Should I move back? Or at least invest?

You've probably heard the term before. But what does it really mean?

Gentrification happens when more affluent residents move into an older or poorer area. They build new infrastructures and start new trendy businesses. Slowly, the estate changes. As a result, property prices and rents go up.

In Singapore, gentrification isn't just about aesthetics. It's also linked to government renewal plans (like the URA Master Plan and HDB's Selective En bloc Redevelopment Scheme), better MRT connectivity, developers buying plots of land to build new projects, and other urban planning. For example, when an area becomes more walkable, it may attract a new kind of resident. Then, property prices follow.

But there's also a flip side.

While gentrification brings revitalisation, it can also displace the very communities that made these estates unique in the first place. The aunties and uncles who've lived in the same flat for 40 years now have to put up with renovation noise next door, and they might not appreciate the $7 oat lattes downstairs. It's not always a bad thing. But it's something worth noting.

Tiong Bahru

This is where it all began, really. Way before the rest of the city got in on the caf-and-boutique action, this heritage hood was already turning heads. The estate got conservation status in 2003, and suddenly, it wasn't just aunties at the wet market anymore. We have youngsters sipping flat whites at Tiong Bahru Bakery. Indie bookstores and art studios start popping up next to old-school provision shops. The neighbourhood became quite vibrant, yet still maintaining its rustic charm. There would be boutique hotels right next to kopitiams, and somehow, it worked.

As the town was going through these rapid changes, expats and returning locals were showing up in greater numbers too. They were attracted to the idea of living in a neighbourhood with character, identity, and history. So naturally, demand for Tiong Bahru properties shot up.

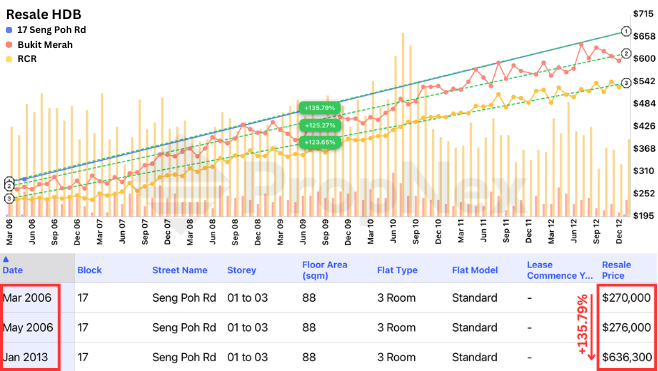

Nearby property values (both public and private non-landed) saw a major boost. Pre-war homes, in particular, were getting a lot more attention, with prices rising by 46% to 76% between 2008 and 2014.

Here is a good example. A standard 3-room unit measuring 88 sqft at 17 Seng Poh Rd was sold in the resale market at $285 psf (purchase price $270,000) in March 2006. By January 2013, a unit with the same specs was sold at $672 psf (purchase price $636,300). That means prices in Tiong Bahru jumped by 135% in under seven years, outpacing both Bukit Merah and RCR, where standard 3-room flats saw slightly slower growth rates of 125% and 123% respectively. Not bad for a bunch of old flats, right?

Source: PropNex Investment Suite

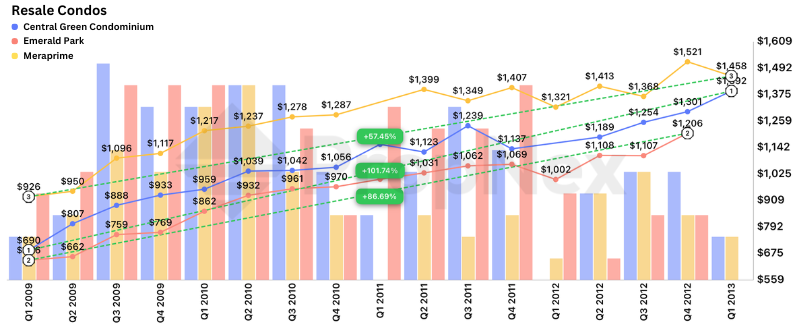

The private market is doing just as well, with prices going up by 57% to 101% between 2009 and early 2013.

Source: PropNex Investment Suite

So in many ways, Tiong Bahru laid the blueprint for what gentrification in Singapore would look like: a blend of nostalgia, lifestyle branding, and rising real estate value.

Punggol

Punggol used to be a fishing village/kampong. Today, it's a completely different place. Initially, the transformation started with the waterfront vision. Suddenly, we had Punggol Waterway Park plus the Waterway Point mall, and new BTOs were launched with phrases like "eco-living" and "smart homes" in their brochures. Now we have cafes next to the canals and there are cycling paths all across the neighbourhood. Even Coney Island got revamped.

Punggol's transformation really kicked off in the early 2010s. The estate had its first executive condo launch (Prive) in 2010. Then two years later, the first condo (Watertown) was launched. It's a sign that the area is garnering real investment potential.

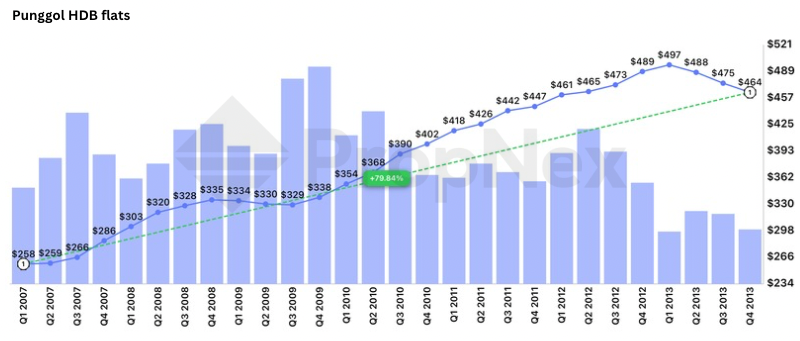

So between 2011 and 2013, even HDB prices in the area started to climb steadily. Demand was hot and buyers were betting on the future of Punggol as Singapore's next waterfront town. It wasn't until several cooling measures kicked in that things started to ease up. But overall, HDB prices in Punggol went up by 79% from 2007 to 2013.

Source: PropNex Investment Suite

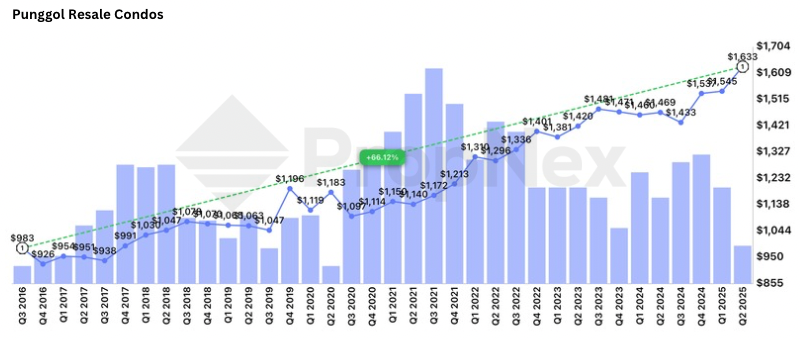

Then in 2016, condos finally hit the resale market, and original buyers began cashing out. Since then, condo resale prices have been going up quite steadily. We actually see a 66% increase since Q3 of 2016.

Source: PropNex Investment Suite

With new developments underway, like the Punggol Digital District (PDD), you can expect property prices to keep going up. Although PDD isn't expected to be fully completed until next year, almost half of the Singapore Institute of Technology's students have already moved to the new Punggol campus. The remaining 8,200 students might start moving in later this year, along with the first wave of tech firms and some food joints. So, for an estate that people used to complain was "so far, might as well go JB", Punggol is doing quite well as it's about to become Singapore's Silicon Valley.

Jurong

Source: jld.gov.sg

There was a time when Jurong was just... swamp. Then in the 1960s, it was turned into an industrial estate, and it worked. By the end of 1967, the Jurong Industrial Estate had pulled in $178 million in investments and created over 6,500 jobs. GDP grew and so did employment. But still, most people wouldn't live there unless they worked nearby. It was hot and kinda far from the city.

But the estate kept evolving. Jurong became a self-sufficient town with an improved transportation network. By 2000, private residential developments started popping up, marking the start of gentrification. Then the government starts improving the area. Schools were renovated and playground areas were expanded. There's a fitness corner for the elderly, ramps for the disabled, covered walkways, repainting, rewiring works, and communal gardens.

Fast forward to Jurong's latest transformation, the Jurong Lake District (JLD). In 2008, the Urban Redevelopment Authority (URA) unveiled big plans to make life in Jurong a lot more liveable. Part of the vision is turning the Jurong Lake area into a water-sports hub with better walking paths and scenic trails for everyone to enjoy. So now, people are saying it could be our second CBD.

Well, that vision has slowly come to life. The area around Jurong East MRT Station is already a bustling mix of offices, malls, homes, and institutions. But by 2027, we can expect to see a new integrated transport hub which includes office and retail spaces, a regional library, a community club, and sports facilities.

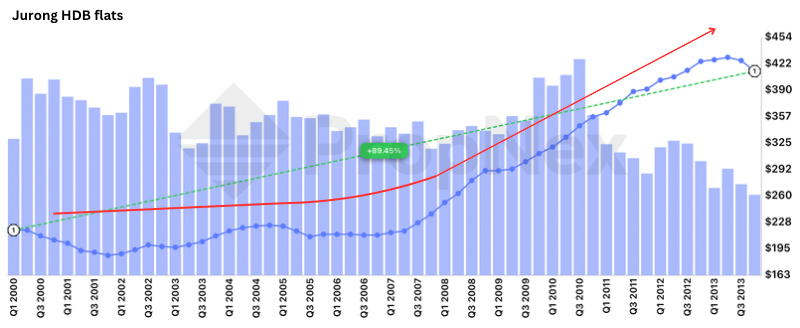

Naturally, all this action has had ripple effects on property. In the early 2000s, HDB prices in Jurong were pretty flat, with the usual dips and bumps but no major movement. But in 2008 (the same year URA revealed big plans for the area), things really picked up. From 2000 to 2013, flat prices in Jurong went up by 89%.

Source: PropNex Investment Suite

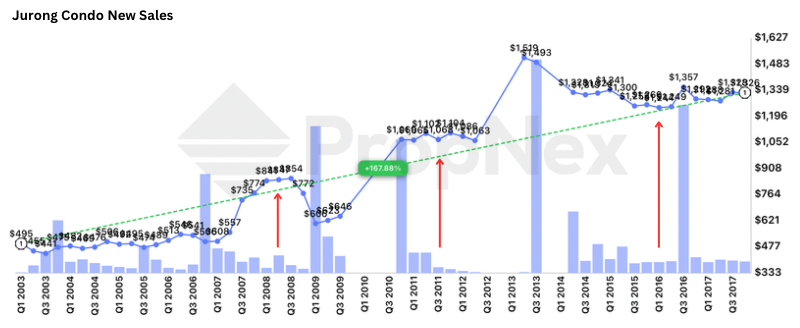

The private property market also grew in the same period. In the early 2000s, new condo launches were going for around $500 psf. By 2008, prices had already crept up to the $700 - 800 psf range. Just a few years later, in 2011 - 2012, it reached the $1,000 psf mark. Then, between 2014 and 2017, prices hovered around $1,200 to $1,300 psf. So overall, from 2003 to 2017, condo new sales at Jurong went up by 167%!

Source: PropNex Investment Suite

Today, new launches in Jurong can command over $2,100 psf. For example, J'den sold 88% of their 368 units on launch day (November 2023) at an average of $2,451 psf. It's basically RCR pricing for an OCR property!

Another example is the LakeGarden Residences, where units can go for at least $1.1M to $5.6M, depending on the size and layout. It's clear that people are seeing Jurong's potential and with more new developments planned for the area, you can bet that property prices in Jurong will continue on an upward trajectory.

Given how "big" Singapore is, you can't really escape gentrification. So it makes more sense for us to adapt and focus on how this knowledge can help you make better property decisions. Because there's no denying that these evolving neighbourhoods offer strong investment potential, especially if you can spot the trend early. By the time an estate is on a "best brunch spots" list, it's probably too late to get in cheap. So, how do you know that a neighbourhood is just starting to gentrify? Here are some telltale signs:

Government Investment: If the URA or HDB is suddenly pouring money into parks, connectivity, or new town hubs, much like JLD and PDD, that's your first sign. You also want to watch out for the upcoming URA Master Plan. See if there are any places marked for future commercial, educational, or lifestyle upgrades.

Cafes, Boutiques, and Art Studios: A neighbourhood that suddenly gets a bunch of "artisanal" businesses where kopitiams used to be could mean more affluent residents are moving in.

Infrastructure Upgrades: New MRT lines, expressways, integrated hubs, or even covered walkways and spruced-up void decks. These attract a new demographic of residents.

School and Campus Relocations: When institutions build new campuses like in PDD, it can indicate a shift in demographics and future rental demand.

It's normal to feel nostalgic about your childhood estate. But you can also feel proud of how far these places have come. Who would've thought the ulu neighbourhood you grew up in would one day have the trendiest cafes and million-dollar flats?

Gentrification might be inevitable in this small city, but it doesn't have to be a bad thing. It's not just about what's changed, but also what that change means. And with the right knowledge, that change can mean opportunity. That is if you can spot the signs early and be bold enough to make a smart property move.

So maybe the next time you visit your old neighbourhood, you won't just feel sentimental. You'll feel a little proud. And maybe a little ready to invest, because your childhood estate might just be the next big thing.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.